In 2019, while 61 percent of white households owned stock, only 33.5 percent of Black households owned stock. And while minority stock ownership narrowed between 2016 and 2019, according to the Associated Press, the COVID-19 pandemic and acute recession have “widened the gap again.”

In addition to the disparities between Black and white stock owners, opportunities to invest in Black-owned businesses through public trading remains slim. Per Bank Black USA, there are only eight publicly traded companies owned by Black people: Urban One (UONE), Ping Identity Holding Corp, Global Blood Therapeutics, Axsome Therapeutics, American Shared Hospital Services (AMS), RLJ Lodging (RLJ), and Sycamore Entertainment Group, Inc. (SEGI). These discouraging stats, paired with conflicting information about the stock market, begs the question: Is stock investment a viable way to make money? If you asked Joe Cecala, the founder of the Dream Exchange—the first minority-owned stock exchange—he would say yes, without a doubt.

With over 20 years of experience in business, Cecala is combating a long-standing issue rooted in racism: the wealth gap. According to the 2019 Survey of Consumer Finances, “Black families’ median and mean wealth is less than 15 percent that of white families.” With COVID-19 in the mix, according to the Washington Post, business ownership within the Black community has “plummeted more than 40 percent”—more than any other group.

In an interview with Complex, Cecala debunked myths about investing in stock, explained how and why he’s starting a stock market, and outlined the impact it will have on minority business owners. At the time of this interview, in October 2020, Cecala was working alongside William Ellison, founder of private equity firm Cadiz Capital Holding, to establish the market. Today, Ellison is no longer part of Dream Exchange. Per the Dream Exchange team, “Cadiz Capital has been unable to fund its investment in Dream Exchange,” and the group is looking to expand this opportunity to potential capital providers in the Black community.

With its launch anticipated in the first quarter of 2022, here are five key things you need to know about the Dream Exchange—the first minority-owned stock exchange.

Joe Cecala, a securities lawyer of over 30 years, founded the Dream Exchange back in 2018 after realizing he could help minority-owned businesses and business owners have a fighting chance in growing their companies through stock and investments. Except, instead of joining established stock markets, he decided to blaze a path of his own.

After getting started, Cecala met former co-founder William Ellison. “I’ve got 30 years of really [having] this problem staring at me in the face, knowing I could come up with some sort of structure and solution,” Cecala shares.

Cecala says that the Dream Exchange will not only create a solution to an economic issue, but could form a “ripple effect through the other societal issues.” In a sense, an increase of successful minority-owned businesses should eventually yield more jobs in the communities around them, which should translate to more communal wealth.

In creating the Dream Exchange, Cecala is well aware of the misconceptions and apprehension minority business owners may have around ideas like the stock market and investing. This is why he emphasizes the importance of educating them on the value and opportunities the Dream Exchange will bring to them, starting with a breakdown of what the stock market is.

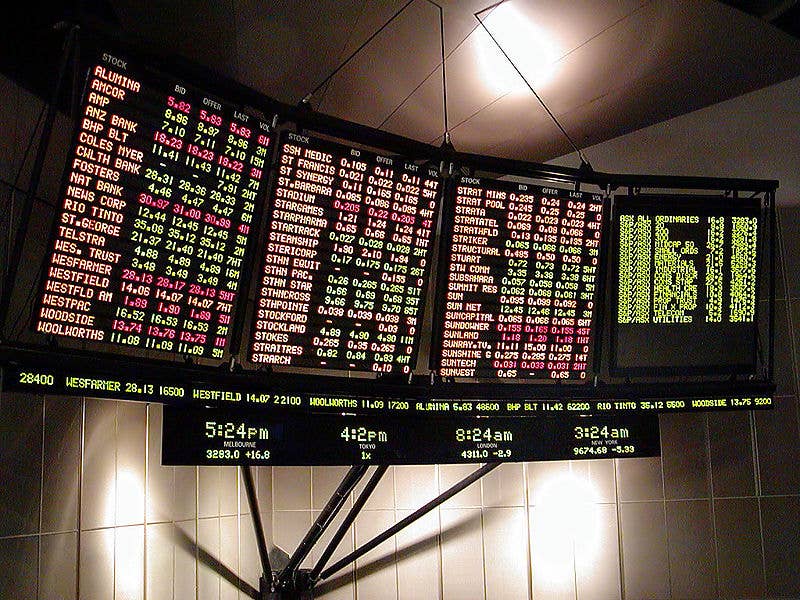

At its most basic level, the stock market lets buyers and sellers to trade shares in companies. For a company to be considered for “auction,” it must first go public through a process called an initial public offering, in which the company offers shares of its business for the public to purchase. There are a number of stock markets a company can have their shares available on, such as the New York Stock Exchange and the National Association of Securities Dealers Automated Quotations, also known as NASDAQ.

Many minority-owned businesses lack access to these stock exchanges. Cecala is creating a space where stock traders can invest in such businesses, helping these enterprises raise capital and build their companies further.

But while the Dream Exchange is lowering the barrier to entry companies face on the stock market, it does have qualifications for companies to meet, and is looking for businesses from specific industries. In an interview with Cheddar, Cecala mentioned some sectors of interest to the exchange: medical technology, oil and gas, cybersecurity, and information technology. Others include environmental waste, agricultural products, organic food, distribution products, and engineering products.

As for the minimum value for a company to reach public trading on Dream Exchange, Cecala says the rules are still being written. “The Exchange anticipates that national market exchange listings will be comparable to other exchanges in operation. However, once the Main Street Growth Act is enacted, the Exchange anticipates that the new listings will open a market to companies with significantly lower market capitalizations.” The current accepted standard value for a private company to enter the public market is $100 million.

Cecala understands that his audience may have stock investments confused with gambling, and he emphasizes that the two are not the same. “One surefire way to not ‘take a loss’ in the stock market is you don’t sell the stock. Keep believing in the company.”

A recent report from the Associated Press with the headline “Stocks are soaring, and most Black people are missing out” supports the claim that minorities, specifically Black communities, are missing out on the benefits of investing in stock for a number of reasons: lack of education, discrimination, fear, and opportunity to build wealth.

One way to reverse the widening wealth gap and increase minority stock ownership is through education. Per Cecala, “The concept of investing is hard work. If you are fully informed, you do the hard work, and invest, most of the time, you win. That’s how these people have become wealthy.” To combat this issue, the Dream Exchange has created a series of webinars to introduce investors and minority-owned businesses to the mechanics of raising capital and investing, according to Cecala.

Cecala says that job growth is one of the Dream Exchange’s many benefits. Starting from a company’s public offering, many roles are involved in the process. Retail investors buy and sell stock through brokerage firms. Brokerage firms act as the middlemen between buyers and sellers. Technology allows for the use of apps like Acorn and Robinhood to act as alternatives to the brokerage firms. All of these positions add professionals to the industry, but the traded companies should benefit the most.

This effect is what Cecala aims to create with the Dream Exchange. “When we go into the public market with all those thousands of potential retail investors, as the value of the company goes up, they’ve harvested the wealth. The money goes into the company, and it utilizes those funds to expand. That’s where the job growth comes from,” he says.

The Dream Exchange is set to launch in early 2022. Users can access the company’s networking software, DreamEx Connect, which brings small businesses and investors together.

Small businesses can upload data about themselves and search for an investor, or vice versa, and connect via a message board. “Just as a normal social media, Facebook-type environment, they can directly get in communication with each other, if they want to go into a transaction and raise money,” says Cecala. As investors and companies link via DreamEx Connect, Cecala emphasizes the tutorials the Dream Exchange offers to help all parties understand how to participate in the marketplace.

Despite the changes in the chain of command at the fledgling market’s headquarters, its mission remains the same—ushering more Black-owned companies onto the stock exchange. And with the rise in Black entrepreneurship, for a new crop of business owners, the Dream Exchange is doing just that.